- Neighbourhood

- >

- Energy

- >

- Solar, Batteries & Electrification

- >

- Sunverge vs Tesla in the AGL VPP

Solar, Batteries & Electrification

Questions and discussion about solar, batteries, and electrification

- Subscribe to RSS Feed

- Mark Topic as New

- Mark Topic as Read

- Float this Topic for Current User

- Bookmark

- Subscribe

- Mute

- Printer Friendly Page

Sunverge vs Tesla in the AGL VPP

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report abuse

Updated to 30 April 2019

SUMMARY

As a retired electrical engineer, I had always assumed that adding solar battery storage would result in an increase in what we save, over and above what we saved by having solar panels only, so I was surprised to find that this didn’t happen with the AGL Virtual Power Plant (VPP) Sunverge system, no matter which way the data was examined.

I have laid out various ways of demonstrating the poor design and inefficiencies of the Sunverge battery hardware and management algorithms. Each analysis shows that the Sunverge system cost us money, instead of saving us money, and the analyses below are just different ways of looking at the same problem. The Tesla system, on the other hand, may save us the sort of money that AGL promised in their initial offering. I have used “may” because we have 1.42 years of Sunverge data, but only 0.50 years of Tesla data, the latter being data from the period of highest solar output from November to April. It still remains to be seen how Tesla performs over a full year of four seasons.

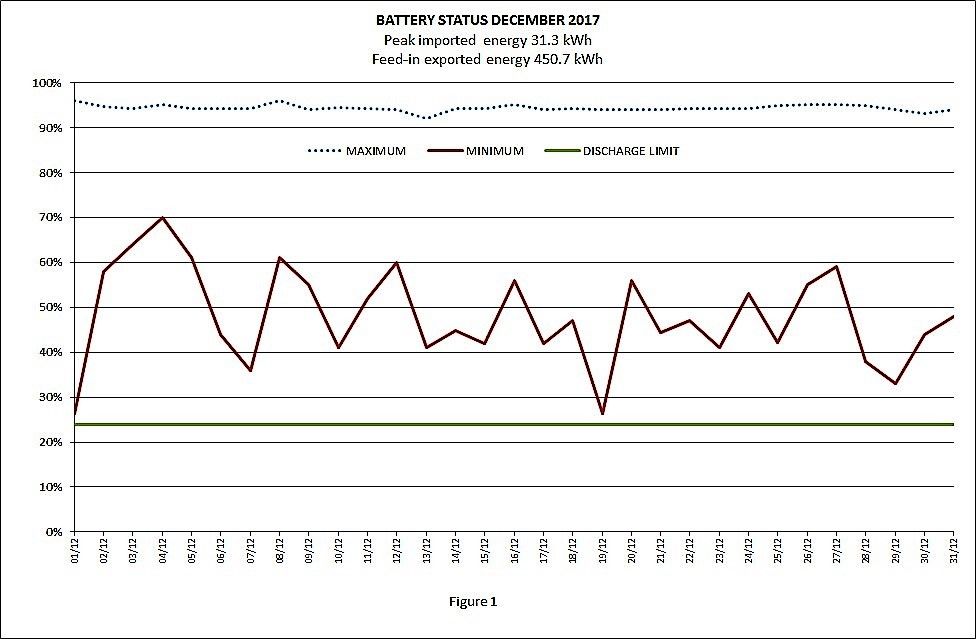

In SUNVERGE DECEMBER 2017 ANALYSIS, I graphically demonstrate that the Sunverge system imported a great deal more daily grid energy for the month of December 2017 than appeared to be necessary.

In SUNVERGE VS TESLA HOUSE VACANT NIGHT-TIME ENERGY FLOW ANALYSIS, I graphically demonstrate the stark differences between the Sunverge and Tesla systems on an half hourly basis between the hours of 6:30 pm and 7:00 am, and when the house was vacant and running only a refrigerator.

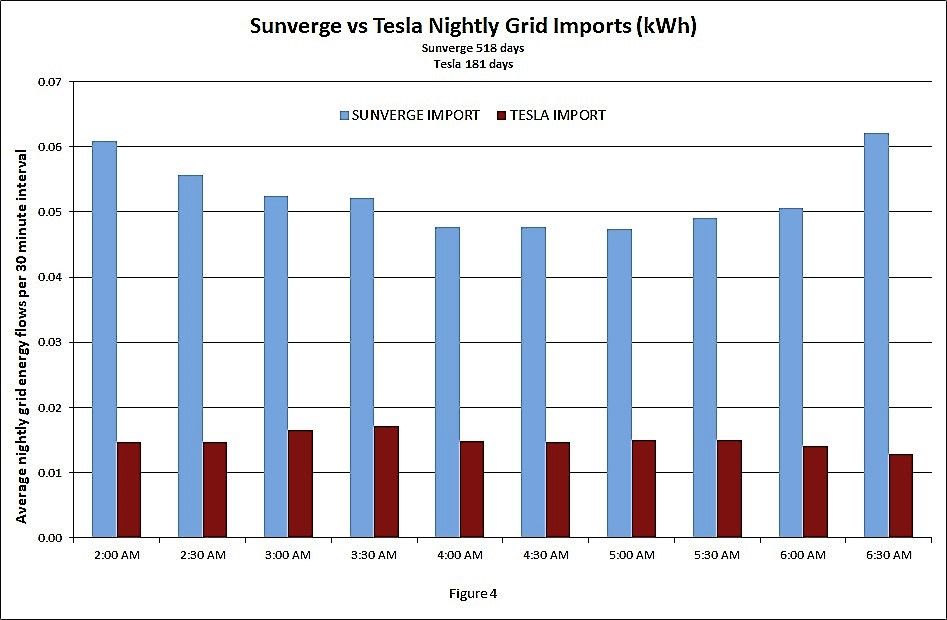

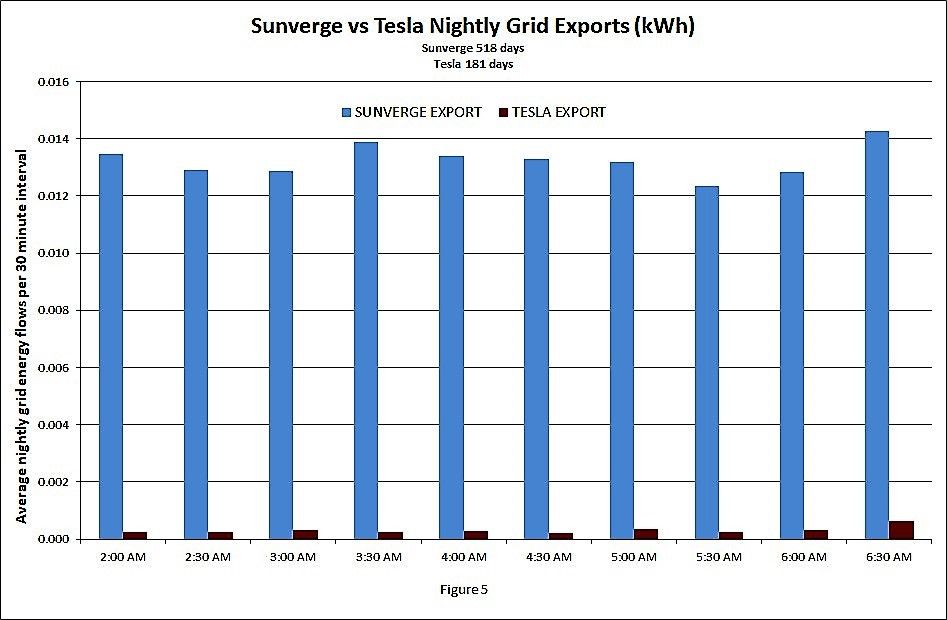

In SUNVERGE VS TESLA NIGHT-TIME GRID IMPORT AND EXPORT ANALYSIS, I graphically show the differences over the current lifetime of both battery systems with regard to the grid energy imported and exported between the hours of 2:00 am and 7:00 am.

In SUNVERGE HOUSEHOLD CONSUMPTION ANALYSIS I provide a detailed numerical analysis of the problem of excess imported grid energy. I have examined, on a monthly basis, all the days in every month in which our consumption exceeded net production, in order to estimate how much energy we really needed to import. I have then compared this estimate with what was actually imported, assuming that on days when consumption was less than net production, we had no need to import any grid energy.

This analysis shows that we paid an extra $438.34 in total over 518 days at then existing tariffs, or $449.21 on current tariffs. Of the total of 1,811 kWh of peak energy imported, 1,256 kWh, or 69%, were excess to requirements. The month by month repeatability of this excess importation of grid energy shows that this problem persisted for the life of the Sunverge system from initial installation until final replacement.

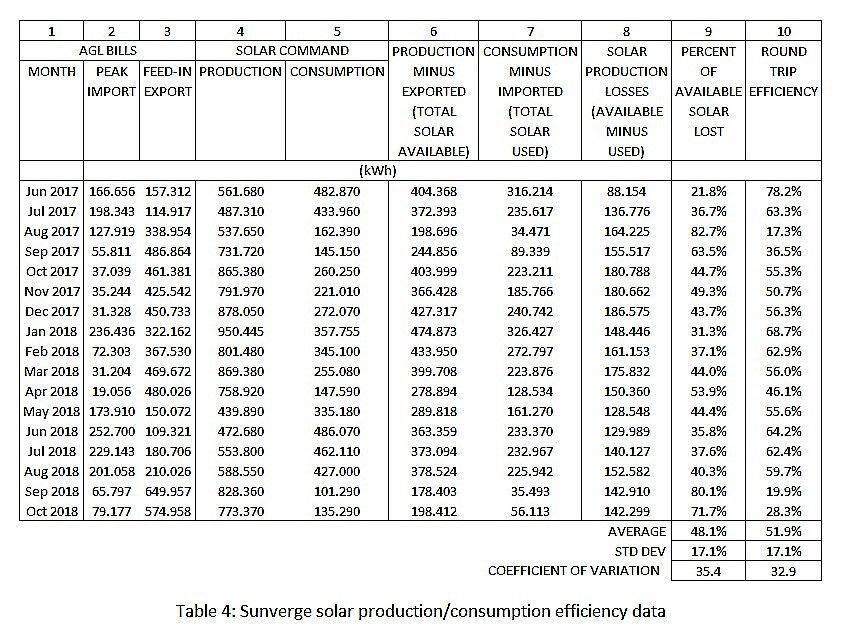

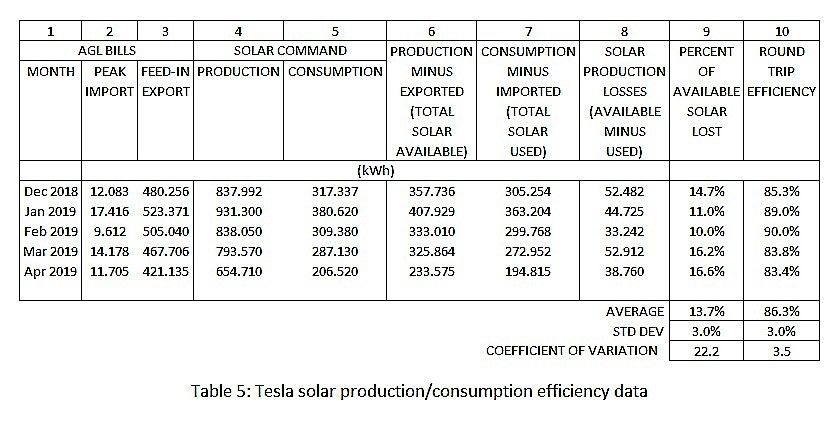

In SUNVERGE VS TESLA BATTERY EFFICIENCY ANALYSIS I have compared 1.42 years of detailed data where we had solar panels and a Sunverge battery, and 0.50 years of detailed data where we had solar panels and a Tesla Powerwall 2 battery.

The round turn efficiency of the Sunverge battery system was measured at 51.9%, compared to 85.8% for the Tesla Powerwall 2 battery. A statistical analysis also shows just how consistent the low efficiency of the Sunverge system was from month to month.

Finally, and most importantly, in SUNVERGE VS TESLA COMPARATIVE COSTS BASED ON AGL BILLING DATA, I have compared 3.50 years of actual costs where we had solar panels only, 1.42 years of actual costs where we had solar panels and a Sunverge battery, and 0.50 years of actual costs where we have had solar panels and a Tesla Powerwall 2 battery. All costs have then been adjusted to reflect current tariffs by applying the respective percentage change of current costs over historical costs.

This analysis shows that the Sunverge battery ran at a loss of $72.40 per annum over 518 days, compared to a profit of $576.22 per annum for the Tesla Powerwall 2 battery over 181 days so far. In other words, the Sunverge battery was eating into the profits we were previously getting from our solar panels, and would never have paid for itself. These Sunverge losses are consistent on a monthly basis over the life of our Sunverge system, and are clearly inherent to that system.

However, if the Sunverge data is analysed over the same months as the data so far available for Tesla, from November to April, then Sunverge shows a profit of $349.76 per annum for that period. This indicates that Sunverge lost $349.76 + $72.40 = $422.17 for the remaining months of the year. It remains to be seen how the Tesla system will perform over those same months.

INTRODUCTION

In this article I have compared 3.50 years of data from 5.2 kW of 260 watt REC solar panels and an SMA 5000TL-21 solar inverter, for the period from 17th November 2013 to 21st May 2017, against 1.42 years of the same panels with an 11.6 kWh Sunverge SIS-7048 DC coupled solar battery, for the period from 26th May 2017 to 31st October 2018, as a part of the AGL VPP.

On 1st November 2018, the Sunverge system was replaced by an AC coupled Tesla Powerwall 2 battery and a Fronius Primo inverter with a Fronius Smart Meter, so this article now includes 6 months of the Tesla Powerwall 2 system.

You may wish to read An Introduction to AC and DC Coupled Solar Battery Systems for an understanding of some terms used in this document.

Our panels face directly north, they are not shaded, and they are at a pitch of 22.5 degrees above the horizontal. Solar production data prior to the battery installation was taken from the SMA inverter via Bluetooth, and after the battery was installed it was taken from AGL’s Solar Command platform.

The gross peak tariffs quoted in this document are the full retail tariff including GST. The net peak tariffs are calculated by first discounting the ex-GST rate at the offered discount rate, and then adding 10% GST. Government feed-in tariffs are always ex-GST. I have excluded state government pensioner discounts and other minor account-based charges, and I have omitted controlled load in this document because it is not pertinent to solar energy generation and storage.

SOLAR BATTERY ECONOMICS

It is important to understand that there are three important considerations in solar battery economics.

The first consideration is the savings from the solar panels alone, which I have demonstrated in The Significant Cost Benefits of Solar Panels. These savings are easy to demonstrate and, on current tariffs, they will quickly pay for the cost of any solar panel installation. The way these savings are generated is by reducing how much grid energy is imported, and creating extra revenue by exporting feed-in energy to the grid. Both of these will almost certainly occur because energy used during daylight hours will reduce importations of grid energy. It is very unlikely however that the total solar energy generated during the day could be used in-house, so the remainder will be exported as feed-in.

The second consideration is the savings resulting from adding a solar battery. These savings are required to pay for the cost of the battery, independently of the solar panel savings. Adding a battery will reduce feed-in revenue, because energy drained from the battery overnight will need to be replaced the next day from the solar panels, instead of being sold as feed-in. Therefore, the cost of a solar battery can only be covered by a significant reduction in imported grid energy.

The third consideration is the fact that storing energy in a battery involves losses. In the normal AC coupled solar battery system, 240 volt AC energy from the solar inverter connected to the panels has to be converted to DC via a battery charger in order to charge the battery, and then converted back to 240 volt AC by a battery inverter to discharge the battery. There are therefore at least three sets of losses; the battery charger, the battery storage process, and the battery inverter. These losses are in the range of 15%-20% for a system that has been well designed and built, but they can be higher. This means that 15%-20% of the energy that was being used in-house, or was being sold as feed-in, when there were panels only, is now lost to the battery charge and discharge process. Therefore, in order to pay for the cost of adding a battery, there must be a further reduction in imported energy, over and above that required by the second consideration above, to cover the losses associated with adding a battery.

SUNVERGE BATTERY HARDWARE AND MANAGEMENT SYSTEM

Sunverge decided, after some experimentation early on, that the battery couldn’t be discharged below 24%, nor charged above 94%. This meant that we could use only 70% of our supposed 11.6 kWh, or 8.12 kWh.

I have used a number of different analyses and graphs to demonstrate the inefficiencies of the Sunverge system, and how much better the Tesla system has proved to be.

SUNVERGE DECEMBER 2017 ANALYSIS

In Figure 1 below, I have used data from December 2017 as a graphical example to illustrate the inefficiency of the Sunverge system.

I have graphed the daily minimum and maximum battery status percentages from Solar Command, and the current battery discharge limit. We were charged for 31.328 kWh of imported peak energy even though, as is evident from the graph, the battery was fully charged each day, and never discharged to the discharge limit of 24%. In fact there was only one day where the minimum daily discharge was even close to the limit.

On that basis, there would appear to have been no need to import any peak energy during December 2017.

SUNVERGE VS TESLA HOUSE VACANT NIGHT-TIME ENERGY FLOW ANALYSIS

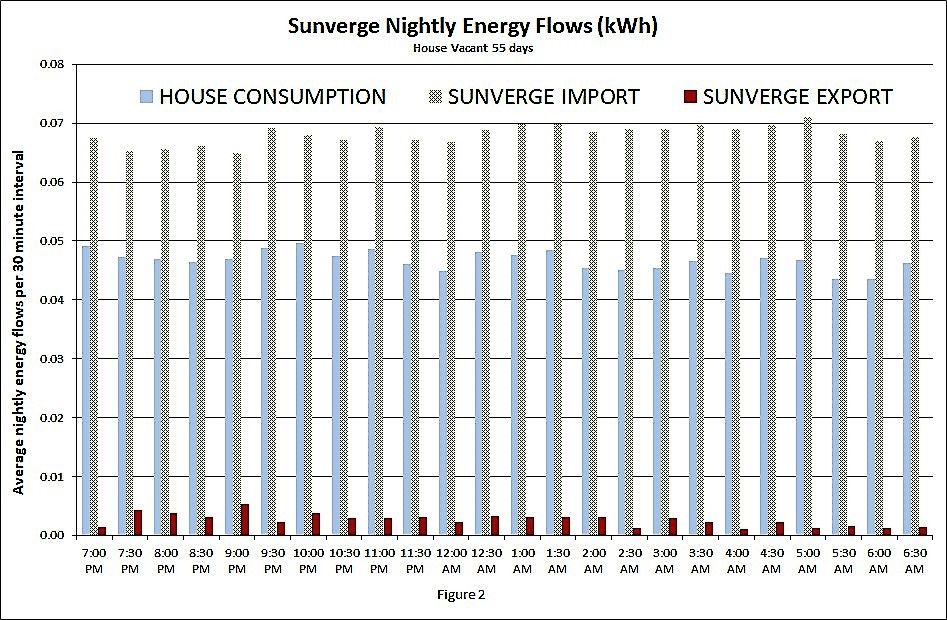

In September and October 2018, the house was vacant for 55 days with just the refrigerator running on the Sunverge system, as shown in Figure 2 below.

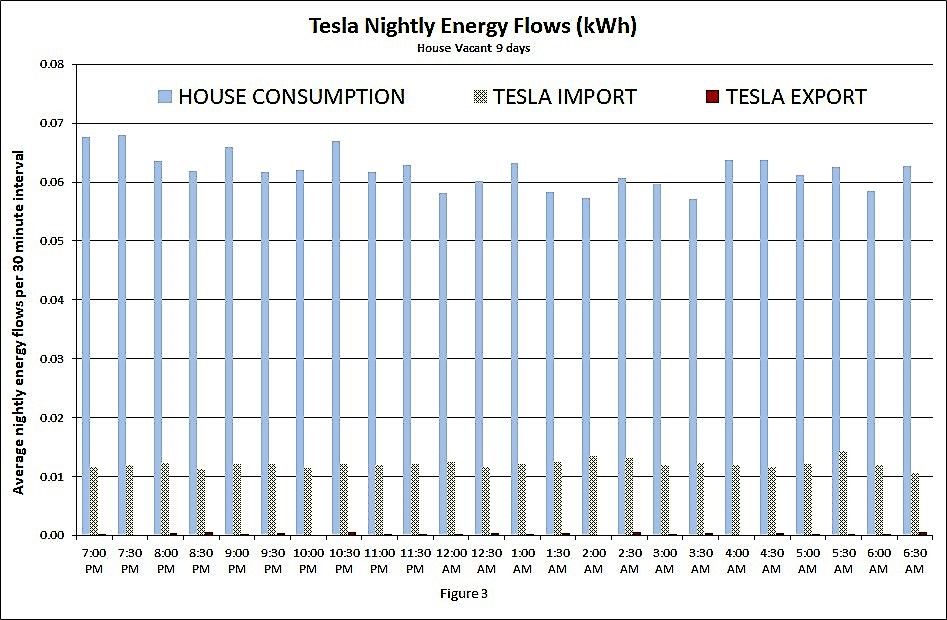

In April 2019, the house was vacant for 9 days with just the refrigerator running on the Tesla system, as shown in Figure 3 below.

In each histogram, I have averaged (over 55 days and 9 days respectively) the half hourly energy values (in kWh) from 7:00 pm to 7:00 am, the times indicated being the start times of each half hourly interval. I have included household consumption data from AGL Solar Command, and import and export data from the AGL usage data file, which is taken from the AGL Smart Meter electricity readings. I have used night time values to remove the effects of solar generation, and more closely compare the two systems when running only off the battery.

In Figure 2 it is evident that Sunverge actually imported more energy during the night than the household consumed, but also exported a significant amount of energy for some strange reason.

Figure 3 shows a similar household consumption, albeit higher overall because ambient temperatures in April 2019 were higher than September 2018, and therefore the fridge would have been working harder. However, the noticeable difference is how little grid energy was imported compared to Sunverge, and how little was exported.

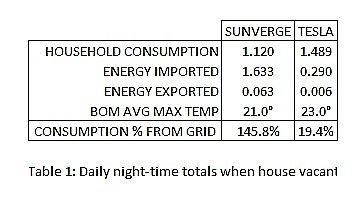

Table 1 below summarises the differences between the two systems, by summing all half hour periods in kWh for each day for the period from 7:00 pm to 7:00 am, and then averaging to produce comparable daily values.

The dramatic difference between the Sunverge and Tesla systems shows up in that Sunverge was actually importing more energy than the house was consuming, and was therefore not using stored battery energy at all.

SUNVERGE VS TESLA NIGHT-TIME GRID IMPORT AND EXPORT ANALYSIS

Figures 4 and 5 below show significant differences between the Sunverge and Tesla night-time grid imports and grid exports. I have used the period from 2:00 am to 7:00 am to provide a comparison free of any solar activity and based on consumption using just the fridge, and no other extraneous loads, such as air conditioners, TVs etc.

In Figures 4 and 5 above, I have averaged half hourly energy values (in kWh) from 2:00 am to 7:00 am for grid imports and grid exports over the 518 days for Sunverge, and 181 days for Tesla. The times indicated are the start times of each half hourly interval. The data is taken from the AGL usage data file, being the AGL Smart Meter electricity readings.

The excessive importing by the Sunverge system is clearly the main reason it severely underperformed compared to the Tesla system. As you will see below, this resulted in significant economic losses.

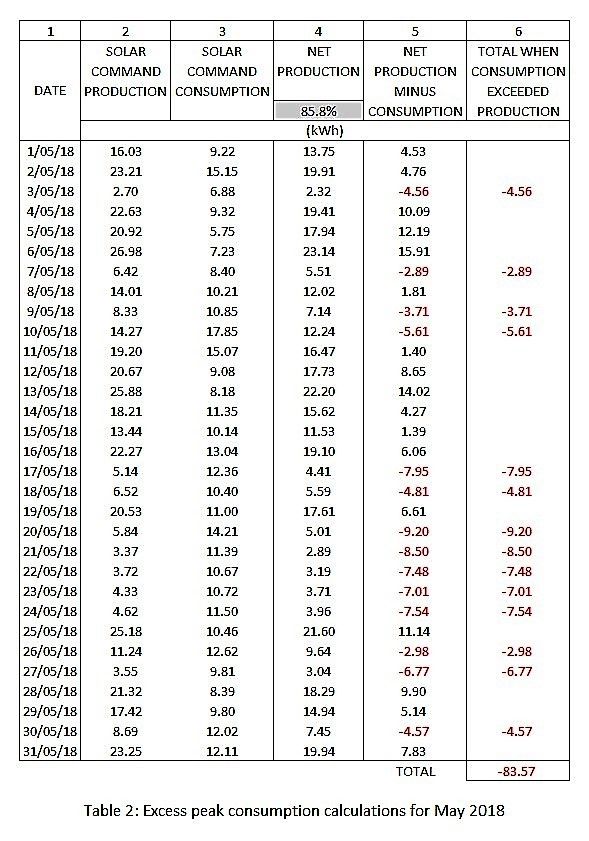

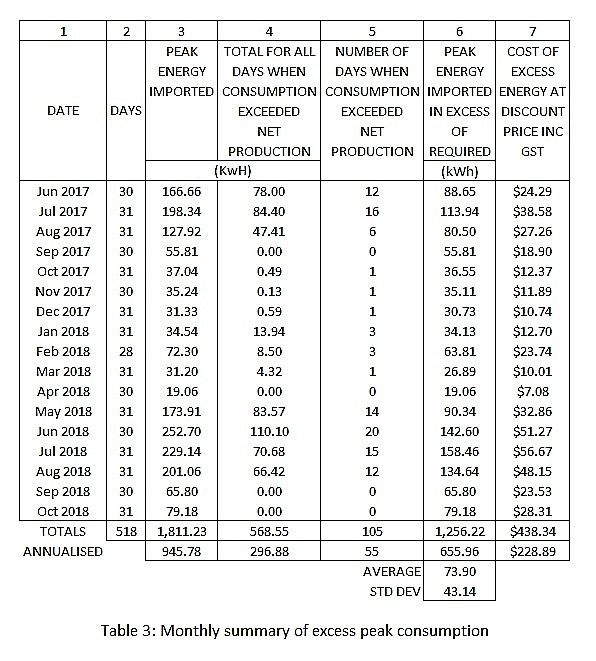

SUNVERGE HOUSEHOLD CONSUMPTION ANALYSIS

In order to provide a detailed numerical analysis of part of the problem, I’ve analysed the data from 1st June 2017, our first full month with the battery installed, until 31st October 2018.

I have examined, on a monthly basis, all the days in each month in which our consumption exceeded net production.

Table 2 below illustrates this process for May 2018. Columns 2 and 3 are taken from Solar Command csv data. Column 4 is net solar production using the Tesla round turn efficiency of 85.8%. I haven’t used the round turn efficiency of the Sunverge battery because of the fact that it imported so much excess grid energy, and its value is therefore not meaningful for the purposes of converting Solar Commands gross production to net production. I have used net production to provide a more accurate real-world analysis, allowing for the losses inherent in converting solar production to energy usable in the house.

Column 5 is net production minus consumption. Column 6 lists the daily amounts of energy for when our consumption exceeded net production. The total of 83.565 kWh is what we really needed to import for May, but the actual imported grid energy for May, as taken from our calendar month AGL bills, was 173.910 kWh.

Table 3 below is a monthly summary, since 1st June 2017, of the process detailed in Table 2 above.

Column 4 shows the monthly totals as derived in Column 6 of Table 2. Column 6 shows the excess energy imported, being the metered and billed imported energy minus the energy we actually needed from Column 4. Column 7 is the cost of the values in Column 6 at the prevailing discounted tariff for that month.

It is interesting to note that this problem was more severe in winter months, but prevalent every month, as shown by the monthly average and standard deviation under Column 6.

On this estimate, the excessive importation of grid energy cost us $228.89 per annum, or $438.34 in total over 518 days at then existing tariffs, or $449.21 on current tariffs. This does not represent the entire economics of the Sunverge system losses, but highlights a particular, and measurable, part of the problem.

SUNVERGE VS TESLA BATTERY EFFICIENCY ANALYSIS

Solar Command provides data on the total gross amount of solar energy produced by the solar panels, and the total gross amount of energy consumed in the home.

If we subtract the feed-in energy exported to the grid from the gross solar production, we get net solar production, which is the total amount of solar energy actually available for use in the home, and to charge the battery.

If we subtract the energy imported from the grid from the gross solar consumption, we get net solar consumption, which is the total amount of solar energy actually consumed in the home, and by the battery.

Remember that any energy required by the battery was energy that was earlier consumed in the home. In other words, energy consumed from the battery is equivalent to solar energy produced from the solar panels, but with some losses resulting from the process of charging, and subsequently discharging, the battery.

The efficiency of the solar battery system can then be defined as net consumption expressed as a percentage of net production, this being a measure of how well the system manages the household loads and the battery. Some energy is always lost in the charging/discharging/inverting process. All inverters will have a minimum threshold load below which the inverter can’t start, and it may need to go to the grid until that threshold is reached. Also there can be a small but finite delay before the inverter can ramp up to power large loads, during which time the grid may be used.

Table 4 above shows how the efficiency values were calculated, and shows quite dramatically how the excessive importation of grid energy by the Sunverge system grossly distorted the values.

The data in Columns 2 and 3 were taken directly from our AGL monthly bills. Columns 4 and 5 were downloaded in csv format from AGL’s Solar Command. Column 6 is the total solar energy available for in-house use, after allowing for the energy exported. Column 7 is the total solar energy used in-house, after allowing for peak energy imported. Column 8 is the difference between the total solar energy available and the solar energy actually used. Column 9 shows the losses in Column 8, expressed as a percentage of net production in Column 6, and Column 10 is 100% minus the losses, or the efficiency.

The very low efficiency numbers are actually a direct result of Sunverge importing so much excess grid energy, particularly at night, meaning the numbers in Column 7 are much smaller than they would have been had we not imported so much extra grid energy. The average, standard deviation and coefficient of variation figures below Columns 9 and 10 clearly show just how consistently Sunverge underperformed month by month for the entire period of 518 days.

These numbers are therefore not a measure of the round turn efficiency of the Sunverge battery, but rather a comment on how the system was managed by Sunverge.

Table 5 below is exactly similar to Table 4, but for the Tesla system only. I have included complete months only, given that the Tesla battery was installed on 1st November 2018. The initial battery charge also considerably altered the data for that month. The difference between the Sunverge and Tesla batteries is very obvious, and the statistics show Tesla to be a much more stable system, not subject to excessive grid importations.

Unfortunately, neither Tesla nor AGL provide any downloadable historical data for the Powerwall 2 system. However, there is a Windows app called Powerwall Companion which does facilitate downloading Tesla data in csv format. The app cannot be used to obtain historical daily data, but by exporting the weekly data on the 8th, 15th, 22nd, 29th and 1st day of the next month, it is possible to gather comprehensive daily data.

Powerwall Companion’s csv export of Tesla data from 1st December 2018 shows the battery has exported 726.27 kWh, and imported 846.74 kWh. The losses in the battery were therefore 120.47 kWh and the round turn efficiency of the battery was 85.8%. This is in very close agreement to the efficiency determined in Table 5 above, and therefore also validates the methodology as applied in Table 4 also.

SUNVERGE VS TESLA COMPARATIVE COSTS BASED ON AGL BILLING DATA

This is a comparative study of what actually happened over the period for which we had solar panels only, compared to the period when we had the Sunverge battery as well, and is by far the clearest indication of what the Sunverge system cost us, and what the Tesla system will save us.

Sunverge

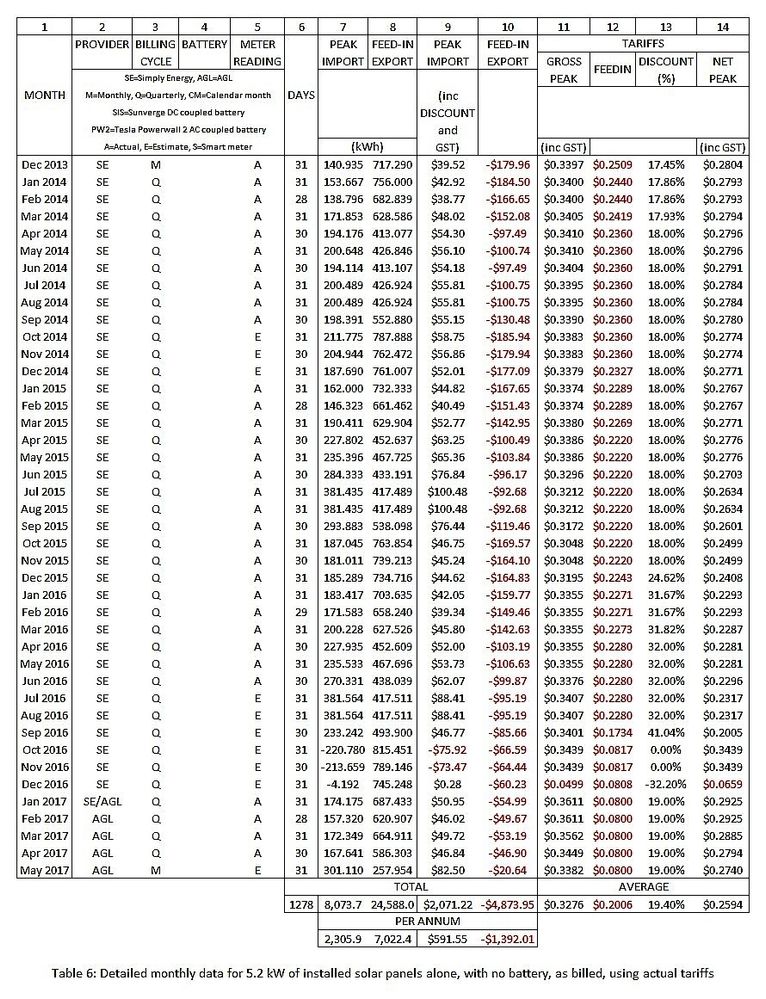

Table 6 below shows the costs, exactly as they occurred, based on having solar panels installed, but no solar battery. The PER ANNUM data at the bottom of Table 6 is derived by dividing the TOTAL values by 1,278 to give a daily average, and then multiplying by 365 to give an annualised average.

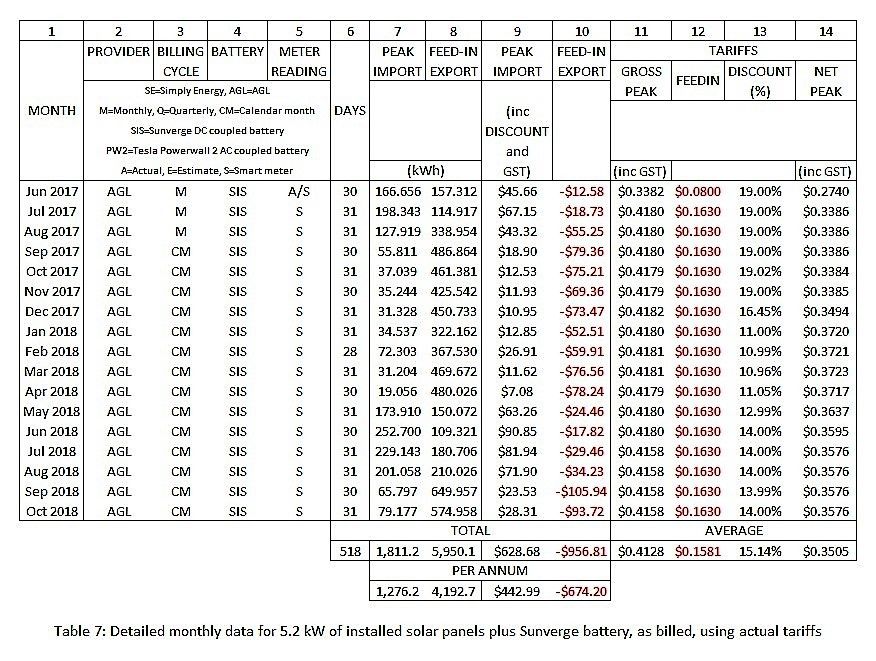

Table 7 below shows the costs, exactly as they occurred, based on having solar panels and a Sunverge solar battery. The PER ANNUM data at the bottom of Table 7 is derived by dividing the TOTAL values by 518 to give a daily average, and then multiplying by 365 to give an annualised average.

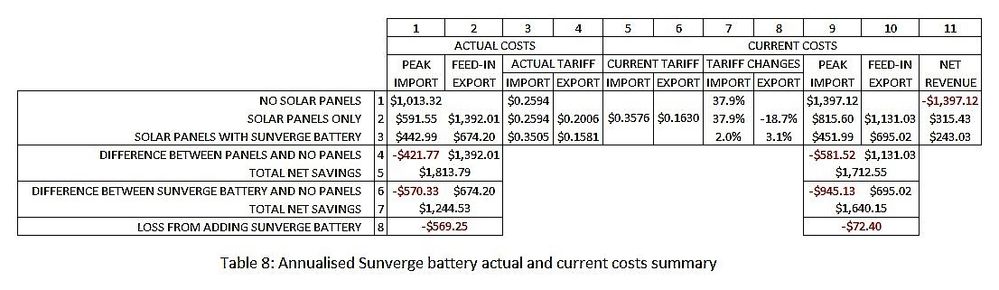

Table 8 above is a summary of annualised actual costs/revenues, taken from Table 1 in The Significant Cost Benefits of Solar Panels, and from Tables 6 and 7 above, and includes annualised costs/revenues adjusted to reflect current tariffs.

Columns 1 to 4 summarise what we actually paid, or were paid, and what the average tariffs were.

Columns 7 and 8 show the percentage changes from the average historical tariffs to current tariffs, and when the costs in Columns 1 and 2 are scaled by these changes, we get the values in Columns 9 and 10.

Rows 4 and 6 show the decrease in imported energy costs and the increase in exported energy revenue, while Rows 5 and 7 show the total net savings resulting from adding both these changes together.

Row 8 is the difference between the total net savings in Row 7 and the total net savings in Row 5; that is, the losses resulting from adding the Sunverge battery to the solar panels.

The loss shown in Row 8 for Columns 1 and 2, as compared to Columns 9 and 10, is a result of much lower import tariffs and much higher export tariffs for the period when we had panels only, compared to the period when we had the Sunverge battery as well, as clearly detailed in Tables 6 and 7.

Column 11 shows net revenues; the difference between revenue earned from exporting energy and the costs incurred in importing energy. Clearly, adding the Sunverge battery has reduced that net revenue by $72.40 per annum.

The difference between actual and current values in Table 8 highlights the difficulty of a simple price comparison over long time frames as a method of measuring any cost benefit from adding a solar battery.

Tesla Powerwall 2

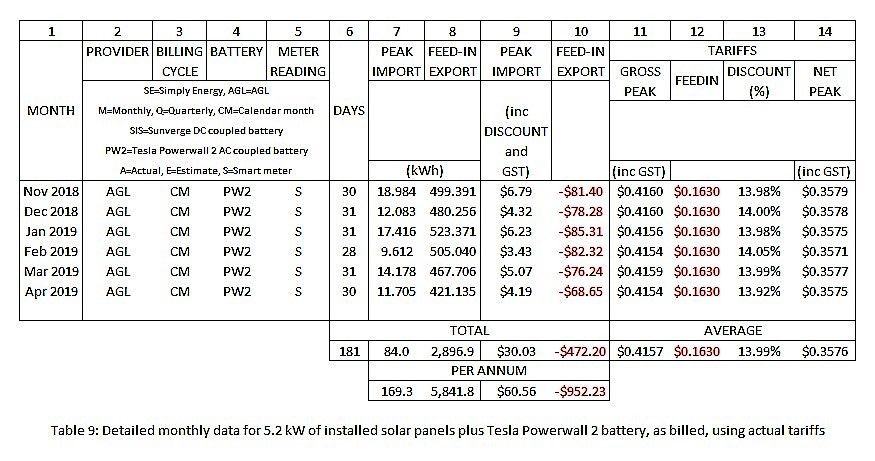

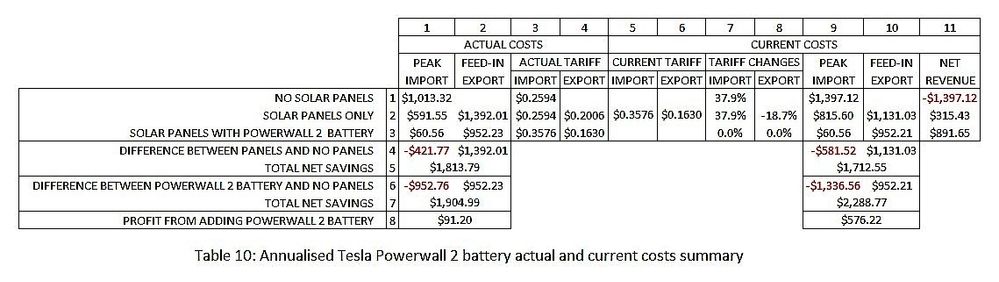

The Tesla Powerwall 2 analysis covers 0.50 years from 1st November 2018, but it is still strongly indicative, even though it involves annualising 181 days of data. Note also that of the 18.984 kWh imported in November, 6.112 Kwh were imported on the first day to initially charge the battery. Tables 9 and 10 below are exactly similar to Tables 7 and 8 above, except they only include data for the Tesla Powerwall 2 battery.

The results at this stage show that the Powerwall 2 will contribute substantially to paying itself off, unlike the Sunverge, in that the net savings over and above having just solar panels are $576.22 per annum.

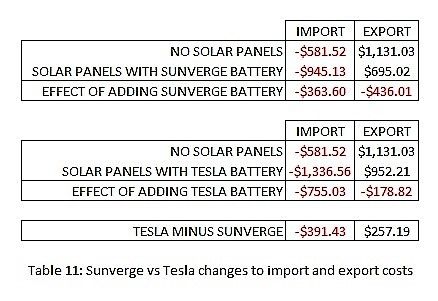

Table 11 below summarises the essential data from Columns 9 and 10 in Tables 8 and 10 above to show why the Tesla battery economics are so much better than Sunverge. All numbers are per annum based.

Table 11 shows that the Tesla system has reduced peak energy grid imports by $391.43 per annum more than the Sunverge did. Feed-in was reduced as a result of adding a battery in both cases, as we know must happen, but I was very surprised to see that the reduction in the Tesla feed-in was significantly less than for the Sunverge, by $257.19 per annum. I assume this is related to the much greater efficiency of the Tesla battery system compared to Sunverge.

Adding the greater grid import savings of the Tesla to the greater grid export revenue of the Tesla leads to a significant benefit of Tesla over Sunverge of $391.43 + $257.19 = $648.62 per annum. This is the same figure, of course, as adding the loss per annum for Sunverge (Table 😎 of $72.40 to the profit per annum for Tesla (Table 10) of $576.22.

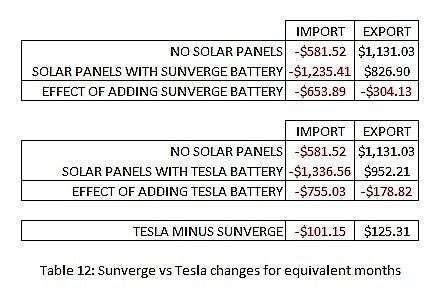

However, these results need to be qualified by the fact that we have 1.42 years of Sunverge data, but only 0.50 years of Tesla data, the latter data being from the period of highest solar output from November to April. Table 12 below is the equivalent of Table 11 above, except it compares only the Sunverge data from the months that are equivalent to the Tesla data so far.

Now adding the greater grid import savings of the Tesla to the greater grid export revenue of the Tesla leads to a lesser benefit of Tesla over Sunverge of $101.15 + $125.31 = $226.46 per annum. This is not an indication that the Sunverge losses are any less than has been previously stated, but that, taken over a full year of four seasons, Tesla may not have the benefits over Sunverge that Table 11 shows. It therefore remains to be seen how the Tesla system performs through the winter months.

CONCLUSIONS

The basis on which the majority of people would have engaged with the VPP would have been to reduce their electricity bills, with backup protection a secondary consideration, especially as the latter was only offered as an option for which they would have to pay extra.

This was clearly stated in AGL’s “Virtual power plant in South Australia, Stage 1 milestone report 31 July 2017”.

“A review of historical solar pricing and installation rates data coupled with qualitative market research showed

that to achieve any sort of energy storage system uptake beyond the niche ‘early adopter’ a simple payback

approaching seven to eight years was necessary.”

Given that the early entry price for the AGL VPP was about $4,000, AGL is clearly saying that customers will save an extra estimated $500 per year by joining the VPP.

In reality, the Sunverge battery system turned out to have cost us money, rather than saving us money, and AGL, to their credit, clearly recognised the need to offer alternatives. The evidence now clearly shows that the Tesla Powerwall 2 system is superior, and may deliver the savings that AGL considered necessary in order to get people to participate in the VPP.

518 days of Sunverge data show that the battery did not contribute to paying itself off, but was a drain on the profits we were getting before Sunverge, when we just had solar panels.

181 days of Tesla data suggests, from Table 10 above, that the current subsidised VPP Powerwall 2 VPP battery cost (with backup) of $8,389 could be paid off in 14.6 years. For those not in the VPP, the latest retail pricing for a fully installed Tesla Powerwall 2 is estimated to be $12,500 - $15,000, with a time of 21.7 years to pay it off at the lower price. These Tesla numbers could become worse with time, given that the 181 days of Tesla data are from the more profitable time of year when solar output is highest.

There are five other aspects of solar batteries worth considering; “free” solar energy, warranties, system repair costs, battery replacement costs, and system monitoring.

There is a strange paradox in solar energy, in that it is not free. In South Australia, every kWh that we use directly during the day costs us $0.16300 in lost revenue, and every kWh we draw from the battery at night costs us $0.1900. The latter cost is $0.16300 increased by the round turn losses of 14.2%, because the energy used at night has to be replaced the next day, and that energy goes through the charge/discharge/invert cycle with its attendant losses. In other words, every kWh used at night uses up 1.166 kWh of solar energy the next day to charge the battery, instead of being exported.

The REC solar panels we have used have a 10 year warranty and a 25 year linearity warranty. This means they are warranted not to degrade by more than 0.7% per annum, which means that after 25 years they will still perform at 84% of their original specification. Most solar batteries seem to have a 5 to 10 year warranty, but often with no linearity warranty. The Tesla Powerwall 2 is, at least, warranted to have 70% of its initial 13.5 kWh usable after 10 years. If the batteries have to be replaced after 10 years or so, this could greatly affect the economic viability of solar battery storage.

Repair costs for solar battery systems will clearly be greater than for a simple solar panel array without a battery. We had two installation faults and at least three run-time failures with our Sunverge battery, so if we were responsible for the repair and maintenance costs, that could have been a significant additional cost. We have had no downtime or problems with the Tesla system so far.

Given the payoff time for a solar battery system currently appears to be in the order of more than 10 years, and the estimated life of the battery appears to be less than 10 years, battery replacement costs may weigh heavily on the decision to install a solar battery.

The only monitoring provided in relation to the Sunverge system was via AGL’s app and the Solar Command website, and neither made it easy to monitor in detail, and in real-time, the battery charge status, household consumption, solar production, and grid exports. The Tesla app, and the Windows Powerwall Companion app, do provide easy real-time access to all these parameters. Unfortunately neither AGL nor Tesla provide any downloadable historical data via a website. I have asked about the possibility of such facilities being provided in the future, and both AGL and Tesla have indicated it might happen sometime, but it is not a priority. I would hope they would both see the need to differentiate themselves in a competitive market place, and offer customers access to their own data.

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report abuse

Note that this write-up refers to an earlier roll-out of the VPP program. We've recently launched some new offers, which you can find out more about here.